Arizona Solar Tax Credit 2025: Don’t Let the Clock Run Out

Arizona Solar Incentives: Don’t Squander These Solar Savings

Updated: November 26, 2025

The One Big Beautiful Bill Act (OBBB), enacted on July 4, 2025, represents a pivotal legislative shift, fundamentally altering the clean energy tax credits and incentives previously established by the Inflation Reduction Act of 2022 (IRA). This legislation accelerates the termination of several key clean energy tax provisions, with profound implications for the solar sector.

Residential Solar Energy Tax Credit in Arizona

For the residential sector, the 30% federal solar tax credit (Section 25D) is abruptly terminated after December 31, 2025, eliminating the gradual phase-down previously envisioned under the IRA. This creates an immediate imperative for homeowners considering solar installations to act within the current calendar year.

Commercial Solar Energy Tax Credit in Arizona

In the commercial sector, solar projects (under Sections 45Y and 48E) now face significantly tightened deadlines. Generally, these projects must be placed in service by December 31, 2027, unless construction commenced by July 4, 2026, which allows for a longer placed-in-service window. Furthermore, stringent Foreign Entity of Concern (FEOC) restrictions have been introduced, impacting supply chains and project eligibility, with some components of these restrictions applying retroactively.

Collectively, the OBBB signifies a clear reorientation in federal energy policy. It moves away from broad, long-term clean energy subsidies toward a more selective approach, coupled with broader tax cuts and a renewed focus on domestic manufacturing and traditional energy sources.

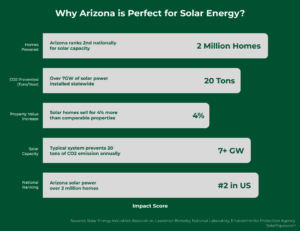

infographic showing statistics for Arizona and solar

infographic showing statistics for Arizona and solar

I. What is in the One Big Beautiful Bill Act (OBBB)

Legislative Context and Enactment Date (July 4, 2025)

The One Big Beautiful Bill Act (OBBB) was formally signed into law by President Donald Trump on Independence Day, July 4, 2025. This legislative action followed intense floor debates and record-breaking vote lengths, ultimately clearing the House on July 3, 2025, to meet the President’s specified deadline. The bill’s journey began with its passage by the House of Representatives on May 22, 2025, followed by the release of the Senate Finance Committee’s text on June 16, 2025.

The primary objectives of the OBBB extend beyond energy policy. It aims to prevent a projected $4 trillion tax increase resulting from the expiration of the 2017 Tax Cuts and Jobs Act (TCJA) and to introduce additional tax reductions designed to stimulate economic growth and support workers. Complementary provisions within the bill include the elimination of federal income tax on overtime and tips, as well as new tax relief measures for seniors.

II. Arizona Residential Solar Tax Credit (Section 25D) Changes

Previous Framework (Inflation Reduction Act – IRA)

Under the Inflation Reduction Act (IRA), the Residential Clean Energy Credit, codified as Section 25D of the U.S. Tax Code, offered a substantial 30% federal tax credit. This credit applied to the cost of new, qualified clean energy property installed in a home, prominently including solar photovoltaic (PV) systems. The IRA stipulated that this 30% credit would be available for systems installed between 2022 and 2032. A gradual phase-down was planned thereafter, with the credit decreasing to 26% for systems installed in 2033 and further to 22% for those installed in 2034.

A notable feature of the IRA’s Section 25D was its flexibility: it imposed no annual or lifetime dollar limit on the credit amount, with the sole exception being for fuel cell property. Furthermore, any unused portion of the credit could be carried forward to reduce tax liabilities in future years. The scope of eligible expenses was also broadened to include standalone battery storage technology, effective beginning in 2023.

How the Accelerated Termination of the Arizona Solar Tax Incentives Affects Homeowners

The OBBB introduces a drastic change to the residential solar tax credit, accelerating its termination significantly. The 30% Arizona residential solar tax credit (Section 25D) is now explicitly terminated for all expenditures made after December 31, 2025. This represents an immediate and complete cessation of the credit.

Crucially, unlike the IRA’s carefully planned, gradual phase-out, the OBBB entirely eliminates the credit after 2025, with no step-down percentages or transitional period. This abrupt removal marks a sharp departure from prior policy.

Impact on Homeowners: Urgency for Installation

The accelerated termination of the Arizona Solar Tax Credit residential solar tax credit imposes a compressed timeline on homeowners. Those considering solar installations now have until December 31, 2025, to ensure their solar panels and associated battery systems are fully installed and commissioned to qualify for the 30% federal tax credit.

This sudden cut has a particularly pronounced impact on working and middle-class families. These households frequently rely on the tax credit to make solar energy financially viable, as it represents an average savings of approximately $9,000. Without this federal credit, the accessibility of solar technology becomes significantly diminished for many middle-class homeowners seeking energy independence.

Battery Energy Storage Systems (BESS): Residential

Residential Energy Storage

The Big Beautiful Bill continues to strongly support residential battery storage, allowing homeowners to claim the 30% Investment Tax Credit (ITC) under Section 25D for systems installed through 2032. Beyond 2032, the credit gradually reduces to 26% in 2033 and 22% in 2034, before expiring in 2035.

Key Highlights for Residential Battery Storage:

- No domestic content requirements: Unlike commercial systems, residential storage is exempt from these rules.

- Standalone storage eligibility: Batteries no longer need to be paired with solar panels to qualify for the ITC.

- Direct pay option: Tax-exempt entities, such as tribal nations and nonprofits, can receive the credit as a cash refund.

This long-term stability makes residential battery energy storage systems (BESS) a sound investment for households, offering enhanced energy resilience and significant savings on utility bills.

How to Manage the Arizona Solar Tax Credit for Leased Residential Systems

The abrupt year-end termination of Section 25D applies only to residential solar systems owned directly by homeowners. Commercial solar projects and residential systems owned by third parties, such as those under lease agreements or Power Purchase Agreements (PPAs), fall under a separate tax credit, Section 48E, which remains available for systems placed in service before 2028.

A key update in the OBBB is the removal of restrictions that previously excluded residential solar leases from qualifying for the 48E tax credit. Now, leased systems can qualify for this credit for several more years. In these cases, the financial benefits of the Arizona solar tax credit go to the solar companies or investors who own the systems, not the homeowners.

This policy change creates a significant financial disparity between owning a solar system and using a third-party lease. Homeowners who previously benefited from the Section 25D credit will lose that incentive, while companies offering leases and PPAs will continue to claim the Section 48E credit. This is likely to accelerate a shift toward third-party ownership models in the residential solar market. While these options lower upfront costs for homeowners, they typically result in smaller long-term savings, as the tax benefits go to the solar companies. This could reshape the residential solar market and increase dominance by larger leasing entities.

III. Arizona Commercial Solar Tax Credit (Sections 45Y & 48E) Revisions

Previous Framework (Inflation Reduction Act – IRA)

The Inflation Reduction Act (IRA) introduced a significant shift towards technology-neutral tax credits for clean electricity generation. These included the Clean Electricity Production Tax Credit (Section 45Y) and the Clean Electricity Investment Tax Credit (Section 48E), designed to incentivize a broad spectrum of clean energy technologies, including solar. Under the IRA, these credits were generally available for facilities that commenced construction by 2033, with a structured phase-down schedule slated to begin thereafter. Specifically for wind and solar projects, the IRA stipulated that credits would begin phasing out for projects commencing construction in the later of 2033 or the year in which the U.S.’s carbon emissions reached 25% of 2022 levels, allowing for placed-in-service dates extending potentially until at least 2037.

New Placed-in-Service Deadlines for Wind and Solar

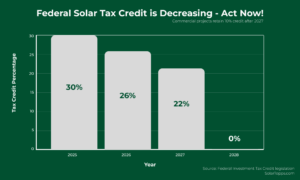

Bar chart Federal Solar Tax Credit is Decreasing- Act now

Bar chart Federal Solar Tax Credit is Decreasing- Act now

The OBBB significantly accelerates the timelines for commercial solar and wind projects. The Section 45Y Production Tax Credit (PTC) and Section 48E Investment Tax Credit (ITC) are now terminated for wind and solar facilities placed in service after December 31, 2027, unless construction commenced by July 4, 2026, which allows for a longer placed-in-service window. This represents a substantial acceleration compared to the longer timelines previously afforded by the IRA.

A crucial exception, often referred to as a “grandfather rule,” preserves eligibility for projects that begin construction before July 4, 2026. This means projects that initiate construction within 12 months following the OBBB’s enactment date may still qualify under prior rules, allowing for more extended placed-in-service dates, typically within four years of the “beginning of construction” (BOC). For instance, projects that began construction in 2025 could be placed in service by the end of 2029, and those with a 2026 BOC could extend to the end of 2030.

Battery Energy Storage Systems (BESS): Commercial & Utility-Scale Storage

For commercial, industrial, and grid-scale storage, the bill preserves the ITC (Section 48E) and PTC (Section 45Y), but with phased reductions:

- ITC (48E): Up to 50% in 2025 (with domestic content + labor requirements), stepping down annually after 2032 and ending in 2035.

- PTC (45Y): Available for projects starting before 2033, then phases out at 25% per year until expiring on December 31, 2035.

Key differences from residential:

- Stricter labor rules: Must meet prevailing wage and apprenticeship requirements.

- Domestic content bonus: Projects using U.S.-made materials can boost ITC value.

- Transferability: Developers can sell credits to third parties, improving financing flexibility.

IRS Guidance for Arizona Solar Tax Credit Deadline Eligibility

The “beginning of construction” concept relies on long-standing IRS guidance, which provides two primary methods for demonstrating BOC: either by incurring at least 5% of total eligible project costs or by commencing “physical work of a significant nature”. These methods, coupled with continuity requirements, are essential for developers to secure eligibility under the new, tighter deadlines. Adding a layer of regulatory complexity, an Executive Order signed on July 7, 2025, directs the Treasury Department to strictly enforce the termination of these credits and to issue new guidance by August 18, 2025. This guidance is intended to prevent circumvention of “beginning of construction” policies and may restrict the use of broad safe harbors, introducing further uncertainty for projects relying on these rules.

For clean energy technologies other than wind and solar (e.g., energy storage, geothermal, nuclear, and fuel cells), the Section 45Y and 48E credits generally remain available for facilities that begin construction by 2033, with a phase-down schedule applying thereafter.

IV. Here is how Solar Topps is different than all the other Arizona solar companies

Solar Topps has been recognized as a 2025 Top Solar Contractor by Solar Power World

The most prestigious annual listing of solar contractors in the United States. This recognition reflects the Phoenix-based company’s significant contribution to 2024’s record-breaking solar installation year and validates their reputation as Arizona’s Most Trusted Solar Company. Since 2009, Solar Topps has installed over 2.25 million solar panels and helped more than 25,000 homeowners make the switch to solar energy, operating as a highly accredited construction engineering firm that delivers better products and better service, always for a lower price. The Top Solar Contractors List honors installers who are decarbonizing the grid and supporting local energy independence, positioning Solar Topps among the nation’s leading solar providers during a critical time for renewable energy adoption. With 99.6% of their systems exceeding performance expectations and over $4.1 billion in property value added for Arizona homeowners, this industry recognition underscores Solar Topps’ commitment to premium solar solutions backed by 25-year warranties and exceptional customer service.

Earlier this year, Solar Topps was proudly named the 2025 EnergySage Installer of the Year, solidifying its reputation as a leader in the competitive solar industry. With a focus on local expertise and transparent communication, we prioritize building lasting relationships over chasing quick sales. Our commitment to excellence is reflected in the trust and satisfaction of thousands of happy customers.

Solar Engineering, Procurement, and Construction Company

We are more than just a solar sales company—we’re a solar EPC. Founded by engineers, our company is built on technical expertise and a deep understanding of the local landscape, ensuring efficiency & excellence in every step of the process. Our team lives and works in Arizona communities. We specialize in overcoming the unique challenges of desert installations. Our expertise extends to meeting utility interconnection requirements and streamlining local permitting processes with efficiency and precision. This expertise saves time and prevents costly mistakes.

Professional certifications set us apart from competitors. Our installers hold current North American Board of Certified Energy Practitioners credentials. They complete ongoing training programs. They stay current with code changes and safety standards. This expertise ensures quality installations that last decades.

Transparent pricing builds trust with every customer. We offer transparent, detailed cost breakdowns from the start, clearly outline all available incentives, and provide honest guidance on financing options. With us, you’ll never encounter high-pressure tactics or misleading claims—just straightforward, trustworthy support. Our reputation depends on satisfied customers.

Premium Products, Not Prices

Quality equipment choices reflect our commitment to excellence. We partner with tier-one manufacturers only. Our panels carry twenty-five-year production warranties. Our inverters include comprehensive coverage. We stand behind every component with our own workmanship guarantee.

Educated Customers

Customer education drives our sales process. We offer realistic insights into system performance, provide precise savings estimates, and share honest information about maintenance needs. Our goal is to empower families to make well-informed decisions. Educated customers become loyal advocates.

Continued Support

Post-installation support continues our relationship. We remotely monitor system performance to ensure optimal operation. Our team responds promptly to service calls, manages warranty claims with efficiency, and provides reliable ongoing maintenance whenever required. Our customers never feel abandoned after installation.

Financial Partner

Financial partnerships expand customer options. We partner with multiple lenders to provide competitive rates tailored to our customers’ needs. Our team simplifies complex loan terms, ensuring clarity and transparency every step of the way. We assist with tax credit documentation, making the process seamless and hassle-free. Most importantly, we secure financing approval before installation begins, giving our customers peace of mind from start to finish. This support simplifies the solar journey.

Community Commitment

Community involvement reflects our values. We proudly sponsor local events and charities, actively support Arizona schools and nonprofits, and prioritize hiring locally whenever possible. Our commitment is to give back to the communities that have helped our business thrive.

Longterm Performance

Performance guarantees protect customer investments. We provide a 25-year warranty on system production and workmanship, ensuring long-term reliability and peace of mind. Our team continuously monitors performance to keep everything running smoothly. Should any issues arise, we resolve them promptly and free of charge. These guarantees provide peace of mind.

The Arizona Advantage Meets Federal Urgency

Arizona blazes trails in solar energy. The state ranks second in the nation for solar capacity. More than seven gigawatts of solar power flow through Arizona’s grid. That energy could power two million homes. The desert state knows how to harness sunshine.

Local utilities support solar growth too. Arizona Public Service offers net metering programs. Salt River Project provides solar incentives. These programs work alongside federal credits. Together, they create powerful savings for homeowners.

The math works beautifully right now. Federal credits combine with state programs. Utility rebates stack on top. Equipment costs keep falling. Installation prices stay competitive. Arizona homeowners win on every front.

This perfect storm of savings won’t last forever. Federal support disappears after 2027. State programs could change. Utility policies might shift. Smart homeowners act while all the pieces align.

The Time to Act is Now Before the End of the Arizona Solar Tax Credit

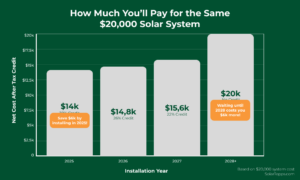

How much you pay for the same $20k system

How much you pay for the same $20k system

The tax credit deadline creates urgency. But rushing leads to poor decisions. Smart homeowners balance speed with careful planning.Arizona’s solar advantages remain strong today. Equipment costs stay reasonable. Installation capacity exists to meet demand. Families who act before the deadline secure maximum savings. They secure today’s incentive rates, begin producing free electricity sooner, and shield themselves from future energy price hikes.

The desert sun shines reliably every day. That energy waits to power your home. The technology works perfectly in Arizona conditions. The financial benefits speak for themselves.

Your solar journey starts with a simple conversation. Professional assessments cost nothing but provide valuable insights. System designs show exactly what solar can do for your family. The numbers tell the complete story.

Arizona homeowners have built a solar success story. Thousands of families enjoy lower electric bills and energy independence. They’ve reduced their environmental impact while increasing their home values.

The Arizona solar tax credit deadline approaches steadily. Each month brings the end closer. But opportunity still exists for families ready to embrace solar energy. The sun keeps shining. The savings keep growing. The future looks bright for Arizona solar with Solar Topps.