What Arizona Homeowners Should Know When a Solar Company Goes Bankrupt (Like Sunnova)

What Arizona Homeowners Should Know When a Solar Company Goes Bankrupt

Published: Tuesday, June 17th, 2025

The solar industry has entered rocky territory again: another high-profile solar company bankruptcy just shook the market. In early 2025, Sunnova Energy filed for Chapter 11, marking one of the largest collapses the industry has seen in recent years. If you’re an Arizona homeowner exploring solar—or already have panels on your roof—this news raises some very real concerns.

After more than 100 solar companies have folded since 2023, including SunPower, choosing a stable solar installer matters now more than ever. Arizona’s solar market remains strong, but national bankruptcies remind us: not all solar companies are built to last.

At Solar Topps, we’ve weathered the ups and downs of this industry for more than a decade. In this guide, we’ll break down what Sunnova’s collapse means for Arizona, steps to take if you’re affected, and how to protect your solar investment long term.

Why Solar Company Bankruptcies Are Impacting Homeowners in 2025

The past two years have been incredibly challenging for many solar firms, with the industry facing significant financial pressures and operational hurdles. Over 100 companies have either declared bankruptcy or shut down entirely, leaving thousands of customers stranded without support for their solar systems. Among these, Sunnova’s bankruptcy stands out as a particularly high-profile case.

Once a prominent national leader in the solar market, the company filed for Chapter 11 bankruptcy, reporting liabilities that exceeded $10 billion. Sunnova’s downfall was accelerated by a series of setbacks, including the cancellation of a $3 billion federal loan agreement, which was expected to provide much-needed relief, and mounting debt it could no longer manage. This collapse highlights the growing financial risks in the solar industry and raises concerns about the stability of other major players in the market.

Top Reasons Why Solar Companies Are Going Out of Business

Why are so many solar companies collapsing? Several key trends have converged to create a tough environment. Rising interest rates have made solar financing more expensive for consumers. In California, the shift to NEM 3.0 reduced financial incentives by up to 75%, slowing new installations and revenue. Additionally, many solar lenders have changed their payment practices, creating cash flow issues for installers who must now wait longer to receive payment after project completion.

Policy uncertainty has also played a role. While federal solar incentives remain in place, political debates about future clean energy funding have made some homeowners hesitant. In Arizona, we haven’t seen the same level of disruption as in California, but we’re not immune to the ripple effects of these changes.

There’s also a business-model story here. Many of the firms that failed were funded by venture capital and driven by rapid-growth strategies. In pursuit of market share, they often sacrificed long-term financial sustainability. When market conditions tightened, these companies couldn’t adjust quickly enough.

In contrast, locally-owned companies with conservative financial practices and diversified revenue streams have remained more resilient. The lesson is clear: solar company stability matters more than ever.

How Sunnova’s Collapse Affects Arizona Solar Customers

If you’re a Sunnova customer, now is the time to take action to protect your solar investment. Start by reviewing your contracts and warranty documents carefully. These papers outline your rights and obligations and will be your most important tools as Sunnova’s bankruptcy moves forward.

Next, contact your original solar installer if they were a separate company from Sunnova. Many solar installations involve multiple parties—the financing company, an installation contractor, and equipment manufacturers. Your installer may still be able to provide service and support even though Sunnova has filed for bankruptcy.

It’s also wise to reach out to your panel and inverter manufacturers directly. In most cases, your equipment warranties remain valid and are not affected by Sunnova’s bankruptcy. Leading manufacturers like Enphase, SolarEdge, and REC typically honor their warranties through their own channels.

If you financed your system through a loan, communicate with your lender immediately. Many solar loans remain in force even when an installer or financing partner goes bankrupt. It’s important to clarify your responsibilities under the terms of your loan.

What Happens to Your Solar lease, PPA, and Warranty After a Company Bankruptcy

For Sunnova customers who entered into solar leases or Power Purchase Agreements (PPAs), the situation may be more complex. These agreements can sometimes be sold to new parties during bankruptcy proceedings. You should monitor court updates carefully, and in some cases, consult a bankruptcy attorney to understand your rights.

Document your system’s current performance while everything is still in your control. Keep a record of recent production data, take photos of your system, and note any maintenance issues. This information will be valuable if you need to pursue warranty claims or seek independent service.

Finally, consider exploring third-party warranty and maintenance options. Independent service providers can step in to monitor and maintain your system if the original installer is no longer available. And if your system develops urgent safety or performance problems, don’t wait—contact a reputable local solar service provider who can help.

Choosing a Financially Stable Solar Company in Arizona

If you’re considering going solar—or switching providers—choosing a stable solar company is the most important decision

you’ll make. The recent wave of bankruptcies has underscored just how critical this choice is.

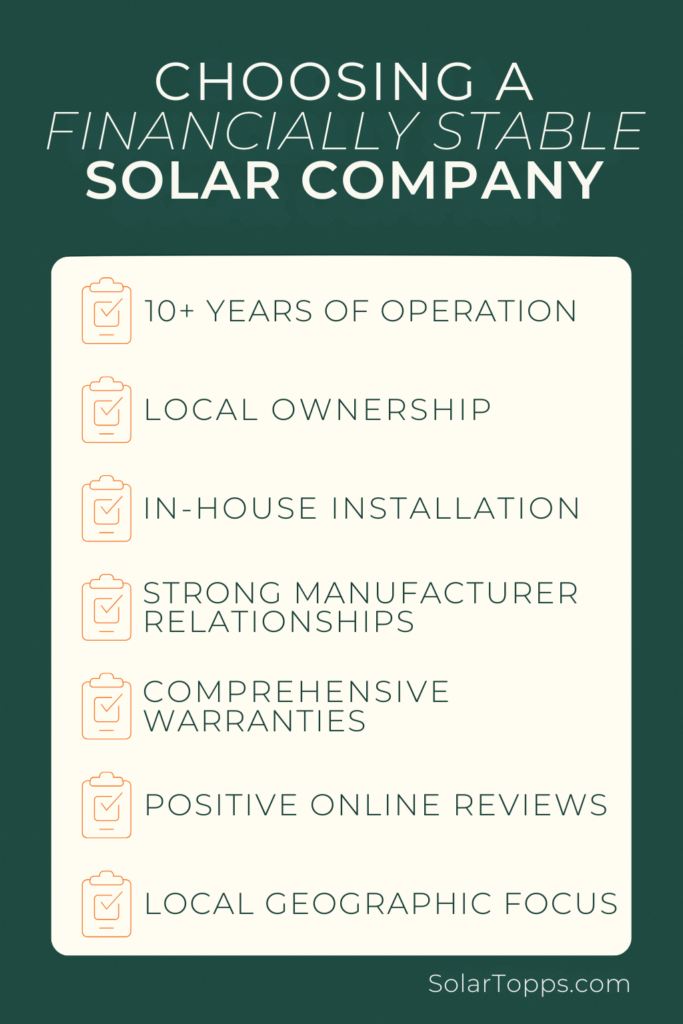

- Start by researching a company’s history. Firms with five or more years of operation have typically proven they can survive industry cycles andchanging market conditions. Look for local companies that own their installation crews and maintain strong relationships with trusted equipment manufacturers. These firms tend to provide better quality control and long-term service.

- Pay attention to ownership structure. Locally-owned companies are often more financially conservative and community-focused, whereas VC-backed firms may prioritize growth at all costs. Local firms also have a deeper understanding of Arizona’s solar incentives, permitting requirements, and utility rules.

- Warranty offerings are another key indicator of stability. Reputable companies will stand behind their work with comprehensive workmanship warranties and strong manufacturer partnerships. Check online reviews—not just star ratings, but how a company handles problems and supports its customers after installation.

- Lastly, consider geographic focus. Companies that concentrate on serving your region are more likely to deliver responsive service and build lasting customer relationships. A solar company trying to cover too many markets may struggle to provide consistent support.

Protecting Your Solar Investment in Arizona’s Changing Market

Arizona’s solar future is bright, but these recent solar company bankruptcies are a wake-up call. Protecting your investment starts with choosing a stable, experienced installer who will be there to support you for years to come.

At Solar Topps, we’ve helped thousands of Arizona homeowners go solar—and stay solar—since 2009. Our local roots, strong financial position, and in-house service team give our customers confidence in every project we complete. If you’re navigating a solar company collapse or considering a new installation, we’re here to help. Schedule your free solar consultation today, and let’s power your future—together.