Ending Homeowners Solar Tax Credit Could Spark a Commercial Solar Boom

Updated: October 24, 2025

Investment tax credits for solar may be heading toward extinction—but for savvy business owners, the solar investment tax credit (ITC) still signals opportunity. While the federal government prepares to pull the plug on the 30% Residential Solar Tax Credit (Section 25D) by the end of 2025, its commercial cousin—Section 48E—is staying intact, at least for now. And that’s a green light for businesses ready to act.

Request your free residential solar quote today!

What You Need to Know: Commercial Solar Tax Credits in AZ

The proposed legislation, passed by the House Ways and Means Committee, would eliminate the homeowner tax credit outright by December 31, 2025. But commercial and industrial (C&I) solar projects will continue to qualify for the full 30% Section 48E credit through 2028, with a slow ramp-down beginning in 2029.

For commercial property owners, developers, and operators, this creates a unique window—a chance to lock in maximum savings while competitors are still reacting to the news.

“If Washington sidelines 25D, the real opportunity shifts to the commercial sector,” says Aaron Nichols, a solar industry strategist.

“48E offers stability, scale, and serious tax benefits. The companies that act now will control the market while everyone else scrambles to pivot.”

Federal Solar Tax Credits Benefit Commercial Solar Projects

With section 48E of the -Solar Investment Tax Credit-in effect, your business can qualify for a full 30% tax credit on eligible solar projects through 2028. Beyond the investment tax credits, solar energy provides the following advantages:

- Energy cost stability in the face of utility volatility

- Reduced operating expenses across facilities, warehouses, and mixed-use developments

- Improved asset value through enhanced Net Operating Injcome (NOI) and marketability

- ESG alignment that checks boxes for investors, stakeholders, and customers

- Resilience during grid outages and extreme weather events when paired with storage

If you’re thinking bigger than your power bill—if you’re thinking about cap rates, IRR, and depreciation—solar isn’t just a good idea. It’s good business.

What you Need to Know About the Residential Tax Credit Changes for the End of 2025 into 2026

Under Donald Trump’s Big Beautiful Bill, the 30% residential solar tax credit is set to be phased out. This means homeowners considering solar installations should act quickly to take advantage of the full 30% credit before it disappears, ensuring maximum financial benefits while it’s still available.

Why Leasing and PPAs Are Back in Play

Here’s another layer: as residential tax credits vanish, leasing and power purchase agreements (PPAs) are becoming viable again. Under both models, solar companies retain system ownership, meaning they—not the homeowner—can claim the 48E commercial tax credit.

This shift makes PPAs and leases a powerful tool for multifamily properties, community-scale developments, and even residential portfolios managed by REITs or institutional landlords. The structure offloads capital costs and responsibility, while still delivering energy savings and compliance benefits. In other words, you get the power without the paperwork—and the developer keeps the tax benefit.

How PPAs and Leases Simplify Solar Adoption

PPAs and leases provide a streamlined approach to solar energy adoption, particularly for multifamily and community-scale projects. By allowing developers to retain ownership of the system, this structure eliminates the need for property owners to manage installation costs, maintenance, or system performance. This hands-off model not only reduces complexity but also ensures consistent energy savings without requiring significant upfront investment.

Unlocking Financial Benefits Through Tax Credits

One of the key advantages of solar PPAs and leases is the ability for developers to claim the 48E commercial tax credit. This tax benefit incentivizes solar deployment at scale, driving down costs for the project and maintaining competitive pricing for property owners or tenants. By leveraging this structure, property managers or landlords can achieve operational efficiency, ensuring compliance with evolving energy regulations while simultaneously attracting sustainability-focused occupants.

The Commercial Solar Clock Is Ticking

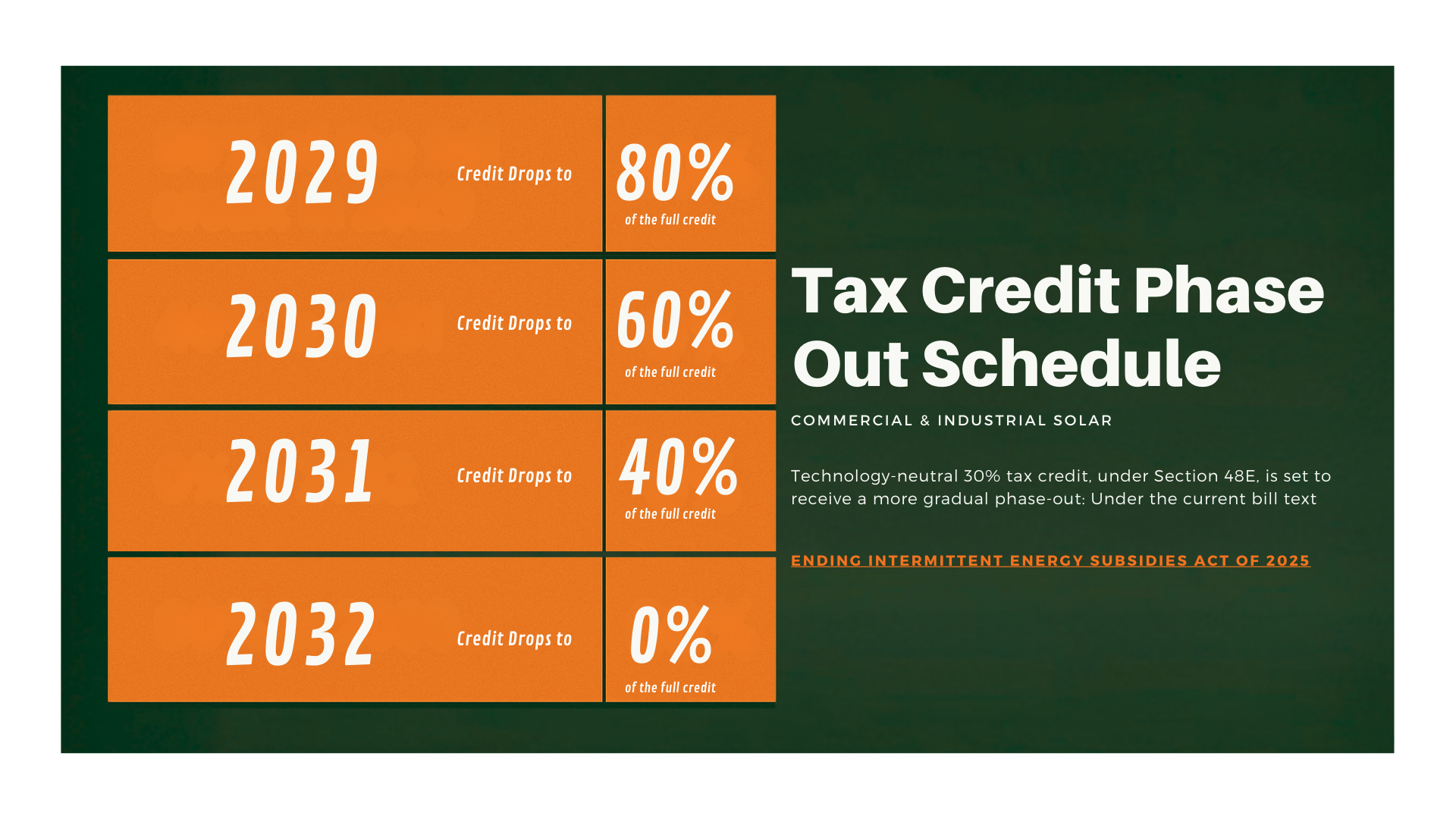

While residential solar faces a significantly shortened timeline, the commercial and industrial (C&I) solar technology-neutral 30% tax credit, under Section 48E, is set to receive a more gradual phase out: Under the current bill text, it drops to:

With lead times tightening and interconnection queues growing, smart developers are moving fast. The sooner your project is underway, the more value you can capture from available incentives before they’re gone—or changed again.

Let’s Get Ahead of the Curve

At Solar Topps, we’ve helped businesses across Arizona switch to commercial solar—on time and under budget. Whether you’re retrofitting an industrial park, developing a new project, or managing a multi-site portfolio, we’ll help you maximize your federal solar investment tax credits, lower your costs, and future-proof your operations.

Schedule a Free Commercial Consultation⇒

The residential market may lose the federal solar tax credits in 2025, but the commercial solar runway is wide open. Let’s take off before everyone else catches on.

Published: May 16, 2025

Published: May 16, 2025