-

Declare Energy Independence this 4th of July with Solar Panels Arizona

This 4th of July, Declare Your Energy Independence with Solar Panels Arizona Published: Wednesday, July 7th, 2025 Every year on July 4th, we celebrate the birth of American independence—the moment we broke free from outside control and forged our own destiny. But in today’s world, solar energy independence Arizona takes on new meaning for Phoenix…

-

Is the Solar Tax Credit Ending?

Published: May 22, 2025 | By SolarTopps Editorial Team Congress Just Voted to End the Residential Solar Tax Credit Recently, the members of the U.S. House of Representatives made a surprising move by voting in favor of a comprehensive federal budget bill. The unexpected approval of the budget bill marks a key step in shaping…

-

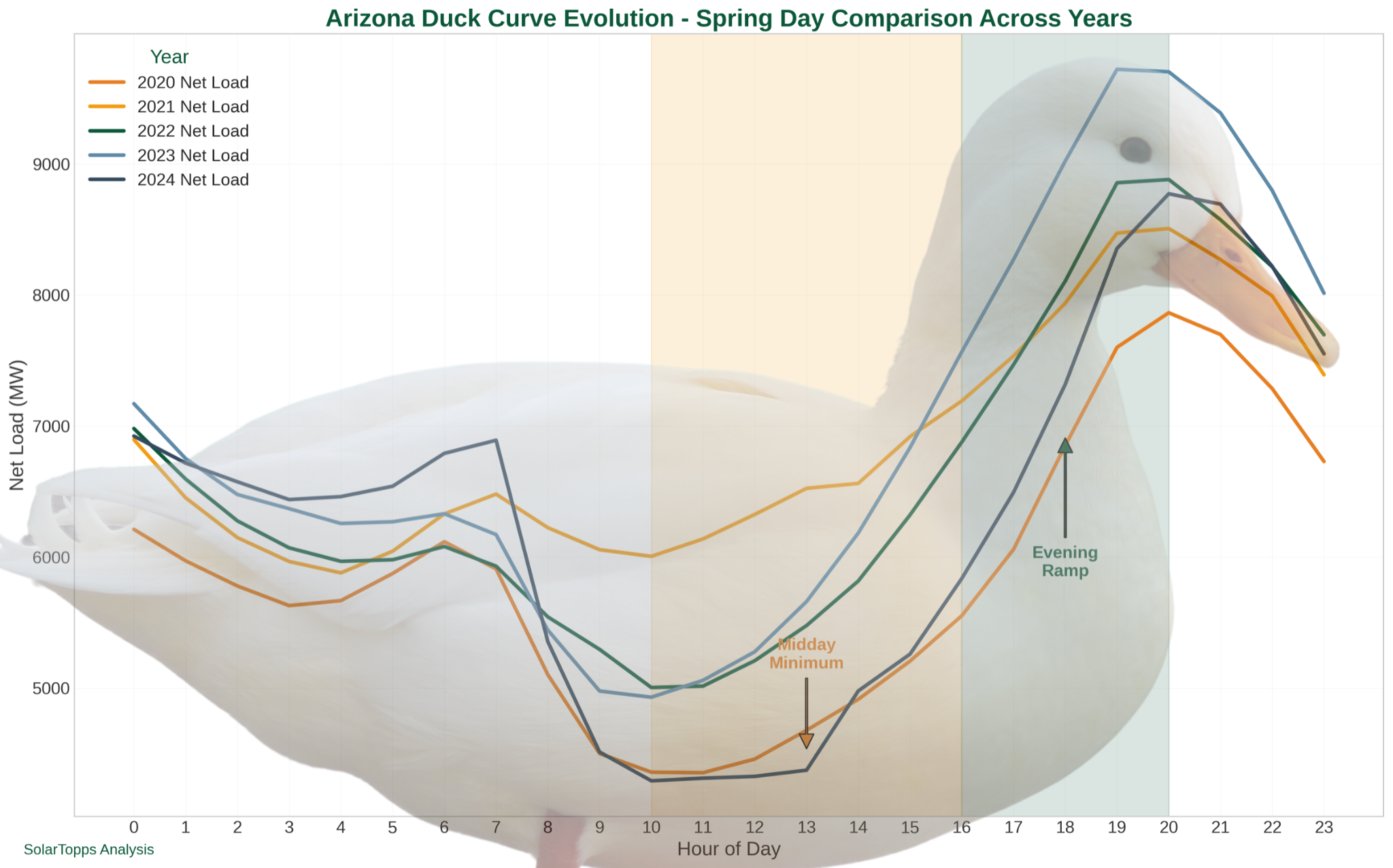

The Solar Power Duck Curve: How to Manage Daily Energy

Understanding and Navigating Arizona’s Duck Curve with Solar Topps Updated: Tuesday, July 8th, 2025 Arizona’s solar adoption creates challenges like the duck curve. Learn how Solar Topps helps residents maximize savings and energy independence. The rapid adoption of renewable energy, particularly solar power, has transformed Arizona’s electrical grid system. As we transition away from fossil…

-

Seizing the Moment for Arizona’s Energy Future (Part 3 of 3)

How ACC Elections Affect the Future of Solar Energy in AZ Updated: June 12, 2025 The Arizona Corporation Commission (ACC) elections offer a chance to replace those in power shaping Arizona’s energy future towards sustainability. The ACC’s recent decisions prioritize short-term gains, favoring utilities over renewable energy and rooftop solar owners. The Core of the…

-

A Call for Democracy in Utility Governance (Part 2 of 3)

A Call for Democracy in Utility Governance (Part 2 of 3) Updated: May 9, 2025 The Salt River Project (SRP) Utility Board and Council Elections on April 2, 2024, have come and gone, propelling us once more into the intricate dynamics that govern our utilities. Pivotal changes were anticipated, some seats exchanged hands, yet a…

-

Reimagining Arizona’s Energy Landscape (Part 1 of 3)

Rooftop Solar Policies and Fair Utility Practices in Arizona Updated: June 13, 2025 In an era where renewable energy, like favorable rooftop solar policy is not just an option but a necessity, the strides made by California in clean energy generation are both commendable and inspiring. Recently announced, within 31 days, California achieved a landmark…

-

Can You Get Solar if You Reside in an HOA in Arizona?

Can You Get Solar if You Reside in an HOA in Arizona? Updated: June 20,2025 Homeowners’ Associations (HOAs) in Arizona are subject to specific laws when it comes to solar energy installations. Under Arizona law, HOAs cannot prohibit homeowners from installing solar panels on their property. This is protected by the Arizona Revised Statutes §…

-

2025 Federal Solar Tax Credit Guide for Homeowners

2025 Federal Solar Tax Credit Guide for Homeowners Updated: July 1, 2025 Welcome to our comprehensive guide on the 2025 Federal Solar Tax Credit! If you’re a homeowner interested in solar energy and looking to save on your taxes, you’ve come to the right place. In this guide, we’ll walk you through everything you need…

-

The Inflation Reduction Act and Solar Energy in 2025

The 2022 Inflation Reduction Act and Solar Energy in 2025 Updated: June 20, 2025 What are the Inflation Reduction Act Solar Benefits? On Tuesday August 16th, President Biden signed the Inflation Reduction Act of 2022 (IRA) into law, making its mark as the single largest clean energy investment in United States history. As part of…

-

Solar Buyback Rate Cuts: A Step Backward for the Solar Industry

Solar Buyback Rate Cuts: A Step Backward for the Solar Industry Updated: June 19, 2025 The recent vote by the Arizona Corporation Commission (ACC) to cut solar buyback rates has raised widespread concerns. This decision will have a significant impact on homeowners with rooftop solar installations and the broader solar industry. In this blog post,…

-

Solar Batteries and Tax Credits: How do they Work?

Solar Battery Storage System: Storage + Tax Credits for AZ Updated: July 2, 2025 With the signing of the Inflation Reduction Act (IRA) into law, Solar Topps wants to ensure that you can maximize the return on your system by helping you take advantage of the extended Federal Investment Tax Credit (ITC). A great way…

-

How to get the Arizona Solar Tax Credit in 2025

How to get the Arizona Solar Tax Credit in 2025 Updated: June 23, 2025 Solar energy is a popular and wise alternative for utility companies, especially in Arizona. Clean, renewable energy is now required by law for utility companies to use when providing energy to their customers. According to the Renewable Energy Standard & Tariff…

-

The Inflation Reduction Act Revives U.S. Solar Energy

How Homeowners Benefit from the 2022 Inflation Reduction Act and Solar Panels Updated: June 16, 2025 On August 16th, 2022, President Biden signed the Inflation Reduction Act of 2022 (IRA) into law, providing historic investment in solar energy. This surpasses the Budget Control Act of 2011. The bill allocates over $300 billion to combat climate…